XRP Price Prediction: How High Will XRP Go Amid ETF Progress and Technical Consolidation?

#XRP

- Technical indicators show XRP trading below key moving averages but finding support at lower Bollinger Band

- Franklin Templeton's ETF progress and Ripple's business expansion provide strong fundamental catalysts

- Price consolidation between $2.1959 and $2.7027 likely to resolve with break above 20-day MA signaling bullish momentum

XRP Price Prediction

XRP Technical Analysis Shows Consolidation Pattern

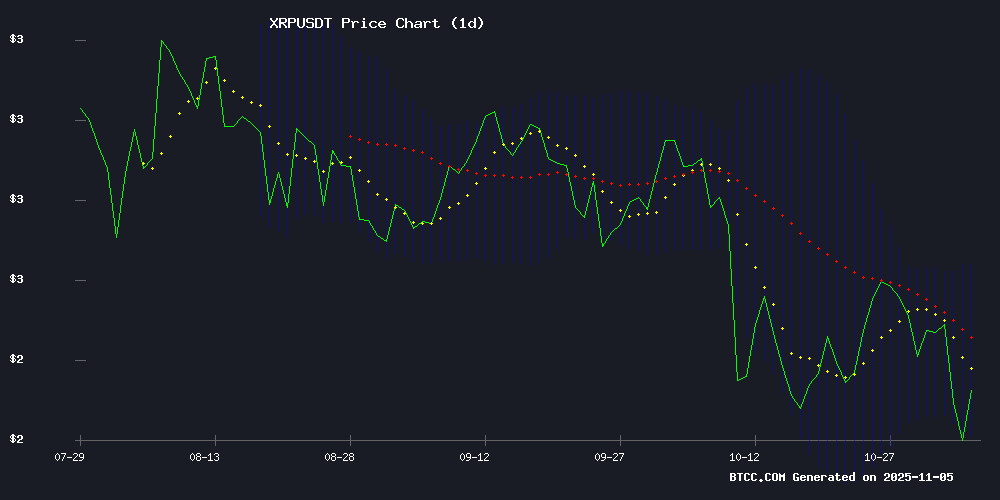

XRP is currently trading at $2.2292, below its 20-day moving average of $2.4493, indicating short-term bearish pressure. The MACD reading of -0.0332 suggests weakening momentum, though the histogram shows some stabilization. The price is trading NEAR the lower Bollinger Band at $2.1959, which may act as support. According to BTCC financial analyst James, 'XRP appears to be in a consolidation phase between $2.1959 and $2.7027, with a break above the 20-day MA needed to signal renewed bullish momentum.'

Positive Catalysts Emerge for XRP Despite Market Weakness

Franklin Templeton's progress on an XRP ETF filing with the SEC represents a significant institutional validation, while Ripple's expansion of US trading services and acquisition of Palisade custody services demonstrates strong fundamental growth. BTCC financial analyst James notes, 'The combination of ETF potential and Ripple's business expansion creates a compelling long-term narrative, though current technical weakness may persist in the short term.' The $25 billion volume surge indicates renewed market interest despite the broader sell-off.

Factors Influencing XRP's Price

Franklin Templeton Advances XRP ETF Launch with Key SEC Filing Update

Franklin Templeton has moved decisively toward launching a spot XRP ETF by amending its SEC registration filing. The asset manager removed the standard '8(a)' delay clause—a procedural hurdle that previously required explicit SEC approval before fund activation. This tactical deletion mirrors strategies used by Bitcoin and ethereum ETF issuers to accelerate listings.

The revised filing now allows automatic effectiveness upon meeting remaining conditions, signaling confidence in imminent regulatory clearance. Market observers interpret the timing as a bet on softening SEC resistance to XRP products amid broader crypto market maturation. Franklin Templeton joins a select group of traditional finance giants aggressively pursuing crypto ETF opportunities.

Ripple Launches U.S. Spot Trading Amid Market Sell-Off, XRP Tests Key Support

Ripple has opened spot trading for U.S. institutional clients through its newly launched Ripple Prime platform, a move that could catalyze demand for XRP despite broader market weakness. The service, enabled by Ripple's acquisition of Hidden Road, facilitates OTC transactions in major digital assets including XRP and its native stablecoin RLUSD—which just surpassed $1 billion in market capitalization.

XRP's price fell 5% to $2.27 amid heavy trading volume, with $8 billion changing hands in 24 hours. The token now approaches a critical support level at $2.20, where market sentiment will determine whether institutional adoption offsets current selling pressure.

Ripple Launches Prime Brokerage Service in US with XRP and RLUSD Integration

Ripple has unveiled Ripple Prime, a new institutional brokerage service in the US, marking a strategic expansion of its digital asset offerings. The platform integrates XRP and its stablecoin RLUSD, providing clients with OTC spot trading, clearing, and financing solutions.

The move follows Ripple's acquisition of Hidden Road, now rebranded under the Ripple Prime umbrella. Licensed brokerage capabilities enable seamless crypto transactions, positioning XRP at the center of institutional crypto finance.

Ripple Acquires Palisade to Strengthen Crypto Custody Services Amid $25B Volume Surge

Ripple has finalized its acquisition of Palisade, a MOVE that significantly enhances its crypto custody capabilities following a notable $25 billion volume increase. The integration of Palisade's wallet-as-a-service technology into Ripple's infrastructure marks a strategic expansion of its institutional offerings.

The deal positions Ripple to better serve banks, fintech firms, and corporations seeking compliant digital asset solutions. Palisade's team will remain intact, now operating at an enterprise scale within Ripple's ecosystem.

This acquisition follows Ripple's $1.25 billion purchase of prime brokerage firm Hidden Road, underscoring the company's commitment to building comprehensive crypto services for traditional finance institutions.

How High Will XRP Price Go?

Based on current technical and fundamental analysis, XRP faces near-term resistance at the 20-day moving average of $2.4493, with stronger resistance at the upper Bollinger Band of $2.7027. A successful break above these levels could target the $3.00 psychological barrier. The positive news flow around ETF developments and Ripple's business expansion provides fundamental support for higher prices over the medium to long term.

| Price Level | Significance | Probability |

|---|---|---|

| $2.1959 | Lower Bollinger Band Support | High |

| $2.4493 | 20-day MA Resistance | Medium |

| $2.7027 | Upper Bollinger Band Target | Medium |

| $3.0000 | Psychological Resistance | Low-Medium |

BTCC financial analyst James suggests that 'while technical indicators show short-term weakness, the fundamental developments position XRP for potential appreciation once market sentiment improves.'